After 15 years of working as an event marketing professional, I decided that I was ready for a new chapter in my life. It was time for me to quit my job and start a business.

The companies I’ve had the pleasure of working with have treated me well, given my family benefits and paid me generously. I sincerely appreciate the opportunities I’ve been given. It was just time for me to follow a new calling.

When I started my podcast in 2016, it was just a hobby. Something to do as a way to give back, learn from others and hopefully help a few people along the way.

As time passed and I learned more about the incredible network in the personal finance community, I discovered there were people who were doing this full-time. Not only were they doing it full-time, but they were also making a solid living and had flexible hours as well.

Fast forward a few years later, I too figured out how to make a living from my hobby and now I have an award-winning podcast and blog that is landing me sponsors, content creation opportunities and speaking gigs.

This wave of opportunity combined with my passion for helping families build wealth and thrive was too hard to ignore.

So I went for it.

But it wasn’t easy to give up a stable career with great benefits and a six-figure salary with two young kids at home. Nicole and I had a lot of conversations and man, did we prepare.

Here are the 10 steps we took to ensure my transition to entrepreneurship was a success.

1. Eliminate Debt

When Nicole and I got married, we both carried some debt into the relationship. I had $30,000 of student loans and she had a $20,000 car loan.

We agreed that we’d tackle the debt together by living on my income alone (at the time it was around $70,000) and using Nicole’s income to pay off our debt. This helped us eliminate our $50,000 of debt in around 12 months.

With no debt or car payments in our lives and lower overall living expenses, we allowed ourselves to be more open for opportunities like part-time work for Nicole, her eventually going full-time Stay-at-Home Mom, or, in my case today, entrepreneurship.

2. Pay Off the Mortgage Early

A few years ago, we were able to pay off our $200,000 mortgage early. We were able to do this by partnering together, keeping our expenses in check and increasing our income.

During this time period, we averaged around $170,000 in income so as I said earlier, I was very grateful for the generous income I received in my career.

Even though we were making great money, we lived on a lot less than we made. Our annual expenses were between $60,000 and $80,000. This helped us to realize we could live on a lot less than we made and feel very happy.

Once the mortgage was gone, I felt a lot more confident, happy and prepared to make decisions that were in the best interest of our family and our future.

3. Save 12 Months of Expenses

About 50% of small businesses fail after the first 5 years. One of the major reasons that they fail is that they run out of money. I didn’t want that to happen to me.

We decided to save up 12 months of expenses in a high yield savings account as a cushion. This made us feel protected as our income was going to be unpredictable at the beginning (no steady paycheck anymore).

Originally, we were going to use this money to buy our first rental property, but we’ve since decided against that. This small business is going to be our first big investment instead.

4. Invest Consistently for Retirement

Over the last decade, Nicole and I have saved for our retirement so that we can take advantage of compound interest while we’re young and save on taxes. Here are the areas where we invested:

401k

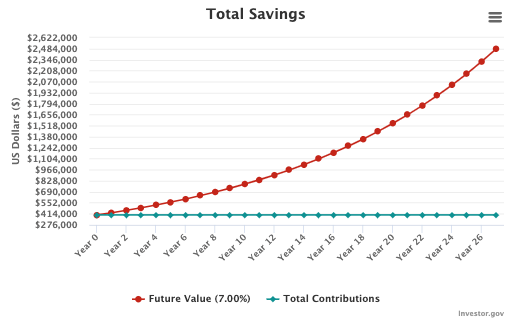

For my last 6 years with my employer, I maxed out my 401k. Combined with the match I received from my employer (another awesome perk), we amassed nearly $200,000. This nest egg, if we didn’t add another dime to it, can grow to around $1.2 million by age 65 (using a conservative 7% growth).

IRAs

Additionally, we have amassed another $100,000 in our IRAs (both Roth and Traditional). If we allow that to do its compound interest growth thing as well, we should have around $600,000 by age 65.

ESOP

Another incredible benefit offered to me by my employer was an Employee Stock Ownership Plan. This was free money given to me for being an employee of the company. Now, I didn’t make it to 100% vesting, but I got to 80%.

In a couple of years, I should have another $100,000 available for retirement funds. This is all in company stock so anything could happen to the value. Based on that, I will be transferring it all over to a Traditional IRA as soon as possible so I can diversify across some select index funds. Again, that should land us around $600,000 come retirement time.

With all those options combined, we should have around $2.4 million (if we don’t invest one more dime into our retirement). Using the 4% rule, that should allow us to live comfortably on around $96,000 per year in retirement.

We’re still planning on contributing more, but knowing those numbers are conservative, we felt very comfortable in taking this entrepreneurial leap.

5. Research the Cost of Health Care

One thing I was always worried about was the cost of health care. If I lost my benefits, how would I get coverage and take care of my family?

Well, it helped me a lot when I started to research it. It wasn’t as scary as I thought.

If I kept my coverage at work through COBRA, it would be around $1,700 per month. That wasn’t bad, but I thought I’d do some more research.

I went on HealthCare.gov and found a High Deductible Health Plan that covers our family (very similar to my coverage at work) for around $1,200 per month. With dental thrown in, we were around $1,300 per month.

And since we went with a High Deductible Health Plan, we continued to invest in our Health Savings Account (HSA) and save and invest for future health care expenses. As that HSA account continues to grow (we partnered with Lively), it gives us even more protection for unexpected health events that may arise.

6. Diversify our Household Income

For the last 5 or so years, Nicole has been a stay-at-home Mom. She started back with part-time work two years ago and her income really helped us plan for the future and have more fun.

Last year, she found a full-time job as an administrative assistant that she really loves. It’s close to the house, she has manageable hours and she still can drop off and pick up the kids for school. Her new income definitely makes this decision a lot easier!

Additionally, my business has multiple sets of income. I have podcast advertising, freelance writing, brand ambassador work, coaching and content creation services that help me diversify my income. If one of them falls flat or goes away, I have the others to lean on.

In my first full year in business, I made just over $75,000. As I head into year 2, I’m hoping this diversification plan will allow us to live a similar lifestyle as we’ve had in the past.

Related Interview: How This Stay-at-Home Dad Makes $200,000 Per Year in Passive Income – with Sam Dogen

7. Try Your Business as Side Hustle First

Jumping right into small business ownership would make me feel nervous. I’ve learned so much over the last 4 years about managing and owning a business.

Being an employee for the last 15 years, I’ve had an HR department, sales team, marketing leaders, accounts receivables and even an accounting department. With entrepreneurship, you have to be ALL of those things.

I’m glad I gave myself some practice to realize this before taking the leap.

Also, by trying out my small business as a side hustle first, I gave myself ample time to decide if I liked it or not. I’d hate to quit my job, start my new business and then decide I don’t like it!

My side hustle time was like a test run beforehand. “Try before you buy” per se!

8. Plan Out Our Budget

Nicole and I know we can comfortably live on $60,000 per year because we’ve done it before. But it was important for us to craft the numbers together and put it into our Mint budget.

The sheer act of writing down the numbers made us feel more comfortable with this big decision. We will have to sacrifice some “extras” for a while as we get used to our new income level, but we’ll be ready.

Related Article: 15 Online Budgeting Apps to Make Your Personal Finance Goals Easy

9. Grow My Network

Over the last 15 years, I’ve developed a solid network of folks who work in the event marketing industry. That network has helped me to get new career opportunities, grow my skills and increase my salary from 5-figures to 6-figures.

Now that I’m jumping into a new industry (personal finance), it was important for me to grow a new network as well. So for the last 3 years, I’ve been making connections, both in-person and online. Through my interviews on my podcast with millionaire entrepreneurs, personal finance experts, and financially independent families, my network has grown substantially.

With a bigger network, you get more opportunities. Based on the connections I’ve made, I was able to receive new opportunities for writing, speaking and content creation.

As they say, your network is more important than your net worth.

10. Take a Leap of Faith

I like to think I was VERY prepared for this big decision, but I know there are thousands of things I’m still yet to learn.

After all, I’ve never done this before.

I've seen days of failure already. And I know more failure will come. There will be more rough days ahead.

But I know there will also be some big wins in my future. And those days will be incredible ones.

I know, either way, my family will be there to give me a hug and say, “You’re doing your best. Keep at it.”

This is an adventure. Pure and simple. That’s what gets me excited. The unknown. The unpredictable.

So here I go. Jumping into year 2!

Wish me luck. I’m going to need it.

Support this Show

If you enjoyed this episode, here are some excellent ways to support the show:

- Leave a review for the show on Apple Podcasts

- Leave a comment below

- Check out my Recommended Resources Page

- Subscribe to the show on Apple Podcasts, YouTube, Spotify, Google Podcasts or Stitcher

- Join our Thriving Families Facebook Community – learn and help other families grow their wealth

I truly appreciate the support everyone!

Carpe Diem Quote

“Go out on a limb. That’s where the fruit is.”

Jimmy Carter

Do you think you could quit your job to start a business? What do you think of these steps toward entrepreneurship?

Please let us know in the comments below.

24 Comments

Congrats, Andy! It’s very motivating to read about how things have built to this level for you and your family… wishing you all continued success in the new decade!

Thank you so much! I’m excited about kicking off my first full month of entrepreneurship in February.

Congratulations Andy! I really enjoy your podcast and can’t wait to see where you go from here! Keep up the great work!

Thanks so much, Eric! I’m so glad to hear you like the podcast. I’ll keep ’em coming!

This is a great article that really resonated with my husband and I! So many entrepreneurial articles stress quitting your job, taking a huge risk. and just “going for it”. We’ve been married 8 months and have started on our journey towards creating the life that we desire and have realized that personal finance is the largely unspoken of key- so we’re starting there. We plan to be debt free (with the exception of our mortgage) by the end of this year and have our house paid off by the end of next year. This article definitely encouraged us!

Wow! You’ve got a great plan and I hope you’ll stay in touch on how you’re doing it. It’s so inspiring hear stories of couples partnering together to hit their big goals.

Congratulations!!! It’s so cool to see other young parents paying off their mortgage and chasing dreams with entrepreneurship :)

Yes, I love having no mortgage. It helps me RELAX!

Day one starts today. Thanks for the support!

Congratulations Andy! I wish you the best in your new journey!

Thank you John!!

Congrats, Andy! Your plan sounds similar to mine. I hope to take my various side hustles full time in the next few years and use our real estate investments to create an extra cushion of passive income.

I can tell you’ve done a lot of planning, and given me a few things to think about I haven’t heard yet. Good luck on the next step of your journey!

That’s awesome! Your real estate investments will definitely help you have that extra safety net and income during your transition.

I’m looking forward to working hard this year so I can enjoy this new entrepreneur life and still help my family thrive.

Andy, congrats! I think our family is on the same path. Right now we are a dual-income household with 2 kids. When the 3rd rolls around, I hope to have done some Life Designing and make some space in my job to enjoy more time at home. Since I have several different income streams now, I feel pretty good about the future and what it holds!

One thing we are hacking in the meantime is summers off. Since my wife works in a teacher role (but not AS a teacher), she basically has summers off (10 weeks). We get this time off daycare too which is really great, it’s a special perk of the daycare we go to. Other programs I’ve looked at don’t give that flexibility so we save a ton this way. I don’t personally have summers off (yet) but it might be a real possibility in a year or two as long as my side income streams continue to grow at the rate they’re growing ???? I’m taking the same approach of experimenting and trying things first to make sure I enjoy them (I do!).

Good luck and enjoy, keep us posted!

Wow! Wouldn’t that be incredible to both have your summers off?

You’re giving me some life goals to shoot for :)

Thanks for the kind words and sharing with me!

Dude! This is awesome and inspiring. Congrats on being able to explore your own business and build something you are passionate about. Exciting stuff, looking forward to reading more and listening to more of your podcast. If you ever need a guest to talk finances, hit me up ????

Thank you so much Todd! I’m thrilled about this decision and so glad you’ll be supporting me. I really appreciate it.

Shoot me an email with ideas on topics for a show – we’re all about Marriage, Kids and Money here!

So awesome Andy! I love the progression you have made since 2016. I’m sure greater things will come!

It took me about 3 years as well before I took a leap of faith (2009-2012).

Congrats!

Sam

Thank you Sam! You’ve had some massive success and I’m happy to be able to share your story next week on the show. I appreciate the encouragement. It’s going to be fun!

Congrats sandy. I might pick your brain and perhaps do a deep dive on self sponsored healthcare. That one continues to be a wildcard for us. In any case. Wish you nothing but success and believe all the steps are pretty spot on to facilitate this new chapter in your life.

Anytime! Feel free to reach out.

We went with a HDHP (around $1250 per month) and we’re going to continue to use our HSA for coverage for the big stuff.

Thanks for the kind words!

Ah!!!! I’m so excited for you! You’re going to do great – but if you decide you don’t like it there is absolutely zero shame in going back to W2 work. Get out there and crush it!

Absolutely! I made sure not to burn any bridges as I might be back. But I honestly appreciated everything my company did for me. If it weren’t for them (and my previous employer) we wouldn’t have hit ANY of these financial milestones.

Andy, this is huge! I can’t wait to see all the great things you will do now that this is a full time gig. Best of luck in your next chapter!

Thank you so much! We are absolutely thrilled!